Foreign Investors Fuel India Equity Exodus

While the withdrawal of FIIs and FPIs is concerning, the increased participation of domestic investors offers a silver lining.The ongoing outflow story underscores the need for India to bolster its investment climate by addressing valuation concerns, accelerating reforms, and ensuring macroeconomic stability

In recent months, India’s financial markets have faced an unsettling phenomenon: the mass exodus of Foreign Institutional Investors (FIIs) and Foreign Portfolio Investors (FPIs). These investors, whose cumulative investments play a critical role in shaping the equity landscape, have been withdrawing substantial amounts of capital, leading to a ripple effect on market indices, valuations and broader sentiment. While significant in itself, this gains greater relevance when juxtaposed with a global economic environment marked by inflation concerns, central bank monetary tightening, geopolitical uncertainties and shifting risk appetites.

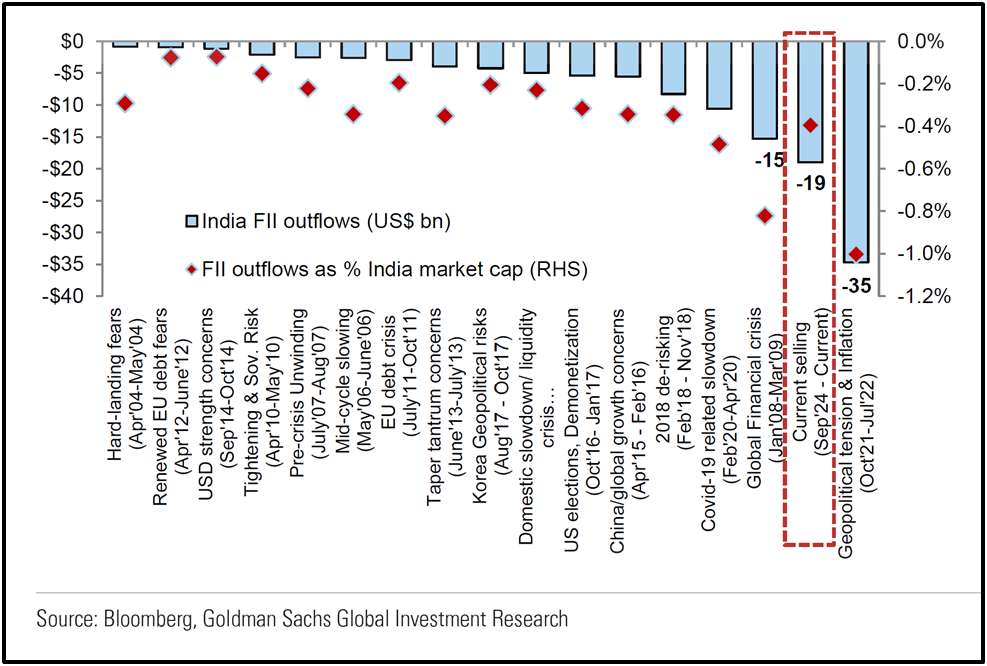

For context, FIIs have pulled out over $19 billion from Indian equities since their peak in September 2024, marking the second-largest outflow in absolute terms in India’s history. Concurrently, about 75% of India’s benchmark BSE200 stocks are trading below their 200-day moving average. Such numbers are not just data points – they signify the shifting sands of global investor preferences and pose critical questions about India’s economic resilience and attractiveness in a volatile world.

Image: The second-largest FII selling in India’s history, based on absolute flows;

Source: Goldman Sachs research (Jan. 24, 2025)

The exodus of FIIs and FPIs from Indian equity markets (and emerging market equities as a whole) is not a random occurrence – it is the culmination of several interwoven factors ranging from global economic shifts to local market dynamics, each playing a role in reshaping investor sentiment and capital flows.

- Global Monetary Policy Tightening and the ‘Risk-Off’ Sentiment

Global central banks such as the US Federal Reserve have aggressively raised interest rates since the start of 2022 to combat inflation. These hikes have made safe assets like US Treasuries (the benchmark rate for global borrowing against which all other asset classes are measured) more attractive compared to riskier emerging market equities, including India’s. When the returns from US bonds increase, they act like a magnet, pulling capital away from higher-risk investments.

This phenomenon has contributed to significant outflows from Indian equities. The MSCI India Index, a benchmark designed to measure the performance of the large and mid-cap segments covering nearly 85% of the Indian equity universe, has dropped by 13% since September 2024. To visualize this, think of global investors shifting their money from fast-moving, volatile rides in a theme park (emerging markets) to a calm, steady carousel (US bonds), prioritizing stability over thrill in uncertain times.

- King Dollar

The US dollar’s rise against global currencies, including the Indian rupee, has been another critical factor. When the dollar strengthens, emerging market assets like Indian equities become relatively more expensive for foreign investors. This often prompts investors to exit such positions, as the returns in their home currency diminish. Imagine a US investor holding Indian stocks – if the rupee weakens, converting their returns back to dollars results in a smaller amount than expected. This dynamic discourages further investments, as profits are eaten away not by market performance but by unfavourable currency shifts.

- Valuation Concerns in Indian Markets

The price-to-earnings (P/E) ratio is like the price tag on a fruit basket at a market – it tells you how much you’re paying for every rupee or dollar of fruit inside, or in this case, earnings. A high P/E means you’re shelling out more for the same basket, so you’d expect it to contain premium fruits (strong future growth), but if the quality inside disappoints, the price feels unjustified.

Indian equities have long traded at a premium, with the forward (expected) P/E ratio for MSCI India at 22.18x, notably higher than its 10-year average, but lower than the current eye-watering 26.58x. This premium has now become a deterrent for foreign investors, especially as earnings growth in key sectors has fallen below expectations. However, this concern is not unique to India – globally, even the benchmark US S&P500 is trading at a lofty P/E of 25.22x, which is significantly above its historical norms.

The divergence lies in the narrative and growth outlook. In the case of the US markets, investor optimism is fuelled by the dominance of large-cap tech companies driving substantial earnings growth. Companies like Apple, Microsoft, and Amazon have consistently delivered stellar performance, benefiting from strong pricing power, global reach, and innovation. This “tech-driven growth story”, epitomised by the mercurial rise of the ‘Magnificent Seven’ stocks, has acted as a magnet for global capital, sustaining the higher valuations despite macroeconomic headwinds.

In contrast, India’s valuation premium lacks a similarly dominant growth driver. While export-oriented sectors like IT and pharmaceuticals have held up well, domestic-facing industries such as real estate, autos, and energy, down by as much as 25% since September 2024, have faltered under economic uncertainty, leading to uneven earnings performance.

- Growth Concerns stabilized by Domestic Investors

Within India, mixed economic activity and weakening consumption trends have compounded foreign investors’ apprehensions. While investment activity has moderated, consumption data reflects an uneven recovery, further dampening confidence. For instance, although India’s GDP growth is projected at near 6% for Q4 2024, it falls short of expectations, signalling even a robust economy like India’s isn’t immune to global headwinds.

Yet, despite the pullout by foreign investors, domestic institutional investors (DIIs) have emerged as a stabilizing force, injecting a net $1.8 billion in 2025 as of Republic Day into Indian markets, reflecting steady confidence among local players who understand market nuances better and see value in the long-term prospects of Indian equities. It’s a bit like a family business where external investors decide to leave, but the founding members step up, believing in their vision and the strength of their operations.

- China’s Resurgence as a Magnet for Capital

China’s recent policy manoeuvres have emerged as a significant pull factor drawing foreign investors away from India – the ‘sell India, buy China’ tactic from late last year. In an effort to counter its slowing economic momentum, China has deployed an array of stimulus measures such as reductions in reserve requirements, mortgage rate cuts and liquidity injections – steps designed to rejuvenate growth and restore investor confidence. For foreign investors China now offers the promise of higher returns, buoyed by these proactive measures.

Yet, this redirection of capital may only prove temporary, according to several analysts cited by Mint, who said while China’s stimulus would likely prove temporary in enhancing the attractiveness of its equities. India’s long-term growth story still held significant appeal.

—

The ongoing outflow story underscores the need for India to bolster its investment climate by addressing valuation concerns, accelerating reforms, and ensuring macroeconomic stability. While the withdrawal of FIIs and FPIs is concerning, the increased participation of domestic investors offers a silver lining. To emerge stronger, India Inc. must seek to balance global and domestic dynamics with measured economic strategies to ensure foreign investors foresee stable economic growth and returns.