The world economy is on a recessionary trajectory- UNCTAD

A detailed scan of major global agencies from World Trade Organization to World Bank, IMF, Asian Development Bank reveals a sharp decline in economic growth projections across the world in the wake of the massive tariff turbulence unleashed by the U.S. administration. The UN Trade & Development agency (UNCTAD) goes a step forward sounding the alarm of a likelihood of a global recession.

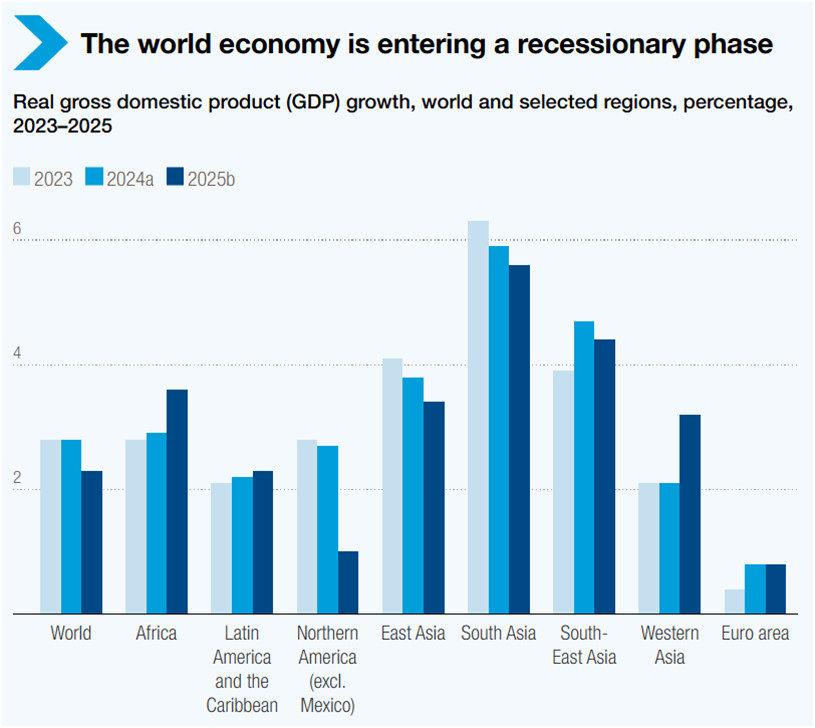

Global growth is expected to slow to 2.3% in 2025, falling below the 2.5% threshold that is often associated with a global recessionary phase, according to the latest UNCTAD report. This marks a sharp deceleration compared to the average annual growth rates of the pre-pandemic period, which were already sluggish.

A WTO report warns that the volume of world merchandise trade could decline by 0.2% in 2025 under current conditions, nearly three percentage points lower than what would have been expected under a “low tariff” baseline scenario, according to the WTO Secretariat’s latest Global Trade Outlook and Statistics report released on 16 April. This is premised on the tariff situation as of 14 April. Trade could shrink even further, to -1.5% in 2025, if the situation deteriorates.

Services trade, though not directly subject to tariffs, is also expected to be adversely affected, with the global volume of commercial services trade now forecast to grow by 4.0%, slower than expected.

The WTO Director-General Ngozi Okonjo-Iweala was highly worried when she said: “I am deeply concerned by the uncertainty surrounding trade policy, including the US-China stand-off. The recent de-escalation of tariff tensions has temporarily relieved some of the pressure on global trade. However, the enduring uncertainty threatens to act as a brake on global growth, with severe negative consequences for the world, the most vulnerable economies in particular. In the face of this crisis, WTO members have the unprecedented opportunity to inject dynamism into the organization, foster a level-playing field, streamline decision-making, and adapt our agreements to better meet today’s global realities.”

At the start of the year, the WTO Secretariat expected to see continued expansion of world trade in 2025 and 2026, with merchandise trade growing in line with world GDP and commercial services trade increasing at a faster pace.

However, the large number of new tariffs introduced since January prompted WTO economists to reassess the trade situation, resulting in a substantial downgrade to their forecast for merchandise trade and a smaller reduction in their outlook for services.

Its World Economic Outlook’s reference forecast includes tariff announcements between February 1 and April 4 by the US and countermeasures by other countries. This had an important on its global growth forecast that was reduced to 2.8 percent and 3 percent this year and next, a cumulative downgrade of about 0.8 percentage point relative to their January 2025 update.

Per the World Bank the global economy faces diverging regional trajectories in 2025 as nations navigate persistent uncertainty and structural challenges. East Asia and Pacific retains its growth leadership at 5.0% in 2024 but anticipates moderation to 4.0% next year, constrained by demographic pressures and climate adaptation needs. South Asia’s projected 5.8% growth masks underlying fiscal vulnerabilities, with tax reforms emerging as critical leverage points to strengthen revenue systems. Meanwhile, Latin America and Caribbean grapples with the twin burdens of stagnating 2.1% growth and escalating debt levels surpassing 63% of GDP, underscoring the region’s need for investment revival strategies. Sub-Saharan Africa shows cautious optimism with growth accelerating to 3.5% in 2025, though progress remains uneven across resource-dependent and conflict-affected states.

The World Bank observes that Europe and Central Asia would confront a pivotal transition as 2.5% growth projections highlight the urgency of private sector revitalization through SME support and workforce modernization. Completing this mosaic, the Middle East and North Africa’s 1.9% growth trajectory reflects systemic productivity challenges, requiring fundamental reforms to unlock private sector potential through enhanced competition frameworks and business climate improvements. This patchwork of regional realities underscores the complex balancing act between short-term stabilization and long-term structural transformation in an era of heightened global economic interdependence.