The US Federal Reserve just delivered an oversized rate cut; here’s why it matters

A bold 0.5% reduction to its funds rate reflects the Fed’s attempt to balance competing domestic economic risks: a cooling labour market and subdued inflation. While that move might embolden emerging markets to loosen their monetary policies aggressively, the global economic impact will largely depend on how exchange rates, inflation expectations, and domestic growth prospects evolve over the coming year.

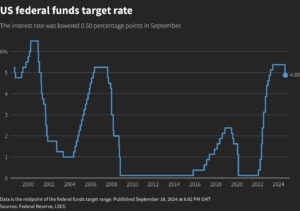

On September 18, 2024, the US Federal Reserve made headlines with a significant decision: a 50 basis-point (bp) cut to its key interest rate from a several decade high of 5.25%–5.50%, lowering it to a range of 4.75–5.00% (4.875%). This move marks the first rate cut since the Fed’s aggressive hikes to combat inflation, signalling a shift in monetary policy that has reverberated through markets and policy circles alike.

Image: The trajectory of the Fed funds rate; Source: Reuters

The decision, which came as a surprise to several market-watchers, who for a considerable period expected a standard 25bp move, is widely regarded as a calculated recalibration designed to address emerging risks in the US economy.

A strategic move to sidestep a looming recession?

The Federal Reserve’s decision to slash rates by 50bp is rooted in several key factors. First and foremost, the Fed has grown increasingly confident that inflation, one half of its central mandate, is more under control. US inflation has slowed to an annualised pace of 2.5%, edging closer to the Fed’s target of 2%. With oil prices softening and rental prices increasing at a slower pace, the Fed now sees inflation risks as diminishing. However, concerns over the labour market have risen, prompting the shift in focus.

Unemployment currently stands at 4.2%, which, while still low, is almost a full percentage point higher than it was in early 2023. Hiring has also slowed, indicating a cooling labour market. Fed Chair Jerome Powell framed the cut as a “recalibration” of monetary policy, balancing inflation concerns with new risks to employment. “We think this is timely,” Powell stated, underscoring the importance of not letting unemployment rise further, especially as economic growth shows signs of slowing down.

The timing of the rate cut is critical. Economic effects of monetary policy changes often take months to filter through the system. By opting for a larger cut now, the Fed hopes to pre-empt further economic slowdown and steer the US economy toward a “soft landing” – avoiding a full-blown recession while minimising unemployment rises. As pointed out in the Federal Open Market Committee (FOMC) summary, the 50bp cut was meant to “recalibrate” the policy stance, ensuring that both inflation and employment risks are “roughly in balance.”

This strategy of pre-emptive action differs from the Fed’s previous stance, where rate hikes were methodically telegraphed to the market. In 2022, the Fed was criticised for being late in reacting to inflationary pressures. By starting the rate-cutting cycle with a large reduction, the central bank aims to avoid a repeat of that scenario, ensuring they are ahead of the curve this time around.

Moreover, Powell emphasised that this move was not necessarily indicative of a long-term trend toward large cuts but rather a strategic decision given the current economic conditions. The Fed’s projections suggest future cuts will likely come in smaller increments of 25bp, with two more cuts expected by the end of 2024, followed by several cuts over the next two years.

A Calculated Risk

While the Fed’s bold rate cut addresses economic risks, it also comes with its own set of challenges and political ramifications. As the Economist highlights, the US economy, despite cracks in the labour market, is still on track for robust growth of about 3% in the current quarter. A hefty rate cut in such an environment could send mixed signals to financial markets. By lowering rates aggressively while the economy is still growing, the Fed risks inflating asset prices and encouraging excessive risk-taking among investors. However, Powell and other Fed officials appear confident that this risk is manageable.

On the political front, the decision could invite criticism from both sides of the aisle, especially with a presidential election looming. Some Republicans, notably former President Donald Trump, may accuse the Fed of trying to boost incumbent Kamala Harris’ prospects by spurring economic growth. On the other hand, Democrats could argue that a smaller rate cut might have indicated that the Fed is still catering to Wall Street’s interests rather than focusing on the labour market.

Adding to the historic nature of this decision is the dissent from one of the Fed’s governors, Michelle Bowman, who preferred a smaller 25bp cut. This marks the first dissent on a rate decision since 2005 and further underscores the tension within the Fed as it grapples with the delicate balance of supporting growth without reigniting inflation.

A new global monetary easing cycle is now underway

This 50bp cut signals the beginning of a new monetary-easing cycle, one likely to continue throughout the coming years, albeit at a slower pace. According to the Fed’s own projections, the path forward includes additional rate cuts in 2025 and 2026, with the federal funds rate expected to settle around 2.9% by 2026. The policy aims to support maximum employment while keeping inflation anchored around the 2% target.

However, the Fed’s approach will be “data-dependent”, meaning the pace and size of future rate cuts will hinge on economic developments, particularly inflation trends and labour market performance. The current forecast suggests that the US unemployment rate will edge higher to 4.4% by the end of 2024, necessitating further cuts, but the labour market should recover by 2025.

The Federal Reserve’s 50bp rate cut marks a pivotal moment in US monetary policy. By acting decisively now, the Fed aims to pre-empt a more severe economic downturn while avoiding the pitfalls of overreacting to near-term growth. As this new monetary-easing cycle unfolds, the Fed’s challenge will be to continue adjusting its policy in a way that supports both employment and price stability, while navigating the political and market risks that come with such historic decisions.

Emerging markets

The outsized Fed rate cut also gives emerging market (EM) economies, which often follow the Fed’s lead closely due to concerns over the stability of their currencies, more scope to loosen monetary policy without triggering severe exchange rate devaluations. This flexibility could reduce borrowing costs, especially for countries dealing with large amounts of dollar-denominated debt, making it easier to manage financial conditions domestically.

In contrast, central banks in advanced economies like the European Central Bank (ECB) and the Bank of England (BoE) are likely to stick to a more cautious approach. Although the Fed’s move signals a shift towards prioritising future GDP growth over immediate inflation concerns, many advanced economies still face stickier inflation, particularly in sectors like services. As a result, they are less inclined to follow suit with aggressive rate cuts, opting for gradual reductions instead.

For instance, the ECB is expected to cut rates by 25bp at consecutive meetings starting in December, aiming to bring policy rates down by a total of 225bp by the end of next year. Similarly, the Bank of England is anticipated to implement only one 25bp rate reduction this year, followed by more cuts in 2025. These steps are indicative of a more conservative stance, with policymakers still focusing heavily on domestic economic conditions rather than external factors like the Fed’s actions.

Another key variable is the potential depreciation of the US dollar. Should the Fed’s decision lead to a sharper-than-expected decline in the dollar, it might pressure some advanced economies to quicken the pace of rate cuts. A weaker dollar could have a broad impact on global trade, improving competitiveness for non-US exporters but complicating inflation control in countries reliant on imports priced in dollars. The Bank of Japan (BoJ), for example, may gain some breathing room from some recent Yen appreciation, which could delay further rate hikes.

The Fed’s pivot signals a broader shift in monetary policy but does not necessarily mark the beginning of widespread aggressive rate cuts across the globe.