The Great El Salvador Bitcoin Miscalculation

El Salvador’s failed Bitcoin experiment, a bold yet troubled venture, offers a stark reminder of the vital importance of prioritising financial stability and robust regulation over purely aspirational visions

In 2021, the Central American country of El Salvador embarked on a radical monetary experiment, becoming the first nation to adopt Bitcoin as legal tender alongside the US dollar. The move, spearheaded by President Nayib Bukele, was touted as a revolutionary step towards financial inclusion, reduced remittance costs, and economic modernisation. However, as the country now seeks financial assistance from the International Monetary Fund (IMF), the experiment appears to have largely backfired, offering a cautionary tale for other nations considering similar ventures.

President Bukele’s decision to embrace Bitcoin was driven by a confluence of factors. First, El Salvador has a large unbanked population, estimated at around 70% of adults, who lack access to traditional financial services. Bitcoin, with its promise of decentralised, permissionless transactions, was seen as a potential solution to this problem, offering a pathway to financial inclusion for millions of Salvadorans.

Second, remittances play a crucial role in the Salvadoran economy, accounting for nearly a quarter of GDP. Traditional remittance channels are often expensive and time-consuming, with intermediaries charging hefty fees. Bitcoin, it was argued, could streamline the remittance process, reducing costs and increasing the amount of money reaching Salvadoran families.

Third, the adoption of Bitcoin was viewed as a way to attract foreign investment, particularly from the growing crypto industry. President Bukele envisioned a “Bitcoin City,” a tax-free haven for crypto entrepreneurs and investors, powered by geothermal energy from the country’s volcanoes.

Finally, there was a sense of defiance, a desire to break free from the constraints of traditional financial institutions and assert El Salvador’s sovereignty in the face of international scepticism. By embracing Bitcoin, President Bukele aimed to position El Salvador as a pioneer of a new, decentralised financial order.

The Harsh Realities of Crypto Adoption

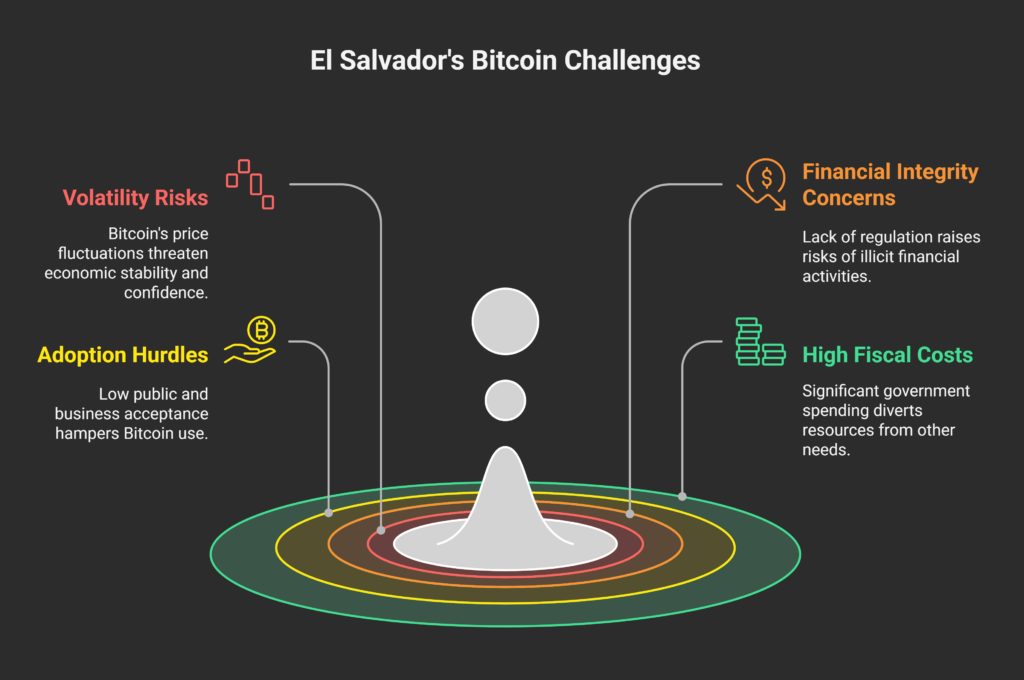

While the vision was compelling, the reality of implementing Bitcoin as legal tender proved far more challenging. The IMF, in its recent assessment of the Salvadoran economy, highlighted several key concerns:

- Volatility: Bitcoin’s notorious price volatility posed a significant risk to financial stability. As a legal tender, Bitcoin’s fluctuations could impact prices, wages, and savings, creating uncertainty and undermining confidence in the financial system.

- Financial Integrity: The lack of regulation and oversight in the crypto space raised concerns about money laundering, terrorist financing, and other illicit activities. The IMF urged El Salvador to strengthen its anti-money laundering (AML) and counter-terrorist financing (CTF) frameworks to mitigate these risks.

- Adoption Challenges: Despite the government’s efforts to promote Bitcoin through the Chivo wallet, adoption rates remained low. Many Salvadorans were hesitant to use Bitcoin, citing concerns about its complexity, security, and acceptance by local businesses.

- Fiscal Costs: The rollout of the Chivo wallet, the establishment of Bitcoin ATMs, and the government’s purchases of Bitcoin have all incurred significant costs, diverting resources from other pressing needs. According to Moody’s, the policy cost $375 million.

The IMF’s Intervention and a Policy Reversal

As El Salvador’s economic situation deteriorated, with rising debt levels and limited access to international capital markets, the country turned to the IMF for financial assistance. The IMF, in turn, made it clear that any support would be contingent on addressing the risks posed by Bitcoin.

The recently approved $1.4 billion Extended Fund Facility (EFF) arrangement reflects a compromise between El Salvador and the IMF. Under the program, El Salvador has agreed to:

- Make acceptance of Bitcoin voluntary for the private sector.

- Ensure that taxes are paid only in US dollars.

- Confine public sector engagement in Bitcoin-related activities and transactions.

- Gradually unwind its participation in the Chivo wallet.

- Enhance regulation and supervision of digital assets.

While Bitcoin may remain a reserve asset on the national balance sheet, its days as legal tender are effectively over. El Salvador has been forced to prioritise economic stability and access to international financing over its crypto ambitions.

El Salvador’s Bitcoin experiment offers several valuable lessons for policymakers considering similar policies:

- Assess the Risks: Before adopting a cryptocurrency as legal tender, carefully assess the potential risks to financial stability, monetary policy, and the broader economy.

- Establish a Robust Regulatory Framework: Implement comprehensive regulations and oversight mechanisms to address the risks of money laundering, terrorist financing, and other illicit activities associated with cryptocurrencies.

- Promote Financial Literacy: Invest in financial literacy programs to educate citizens about the risks and benefits of cryptocurrencies and ensure that they can make informed decisions.

- Prioritise Adoption: Focus on promoting widespread adoption of cryptocurrencies by addressing barriers such as complexity, security concerns, and lack of acceptance by businesses.

- Maintain Fiscal Prudence: Avoid using public funds to purchase or subsidise cryptocurrencies, as this can expose taxpayers to significant financial risks.

- Engage with International Institutions: Consult with international financial institutions such as the IMF and the World Bank to obtain guidance and support in managing the risks associated with cryptocurrencies.