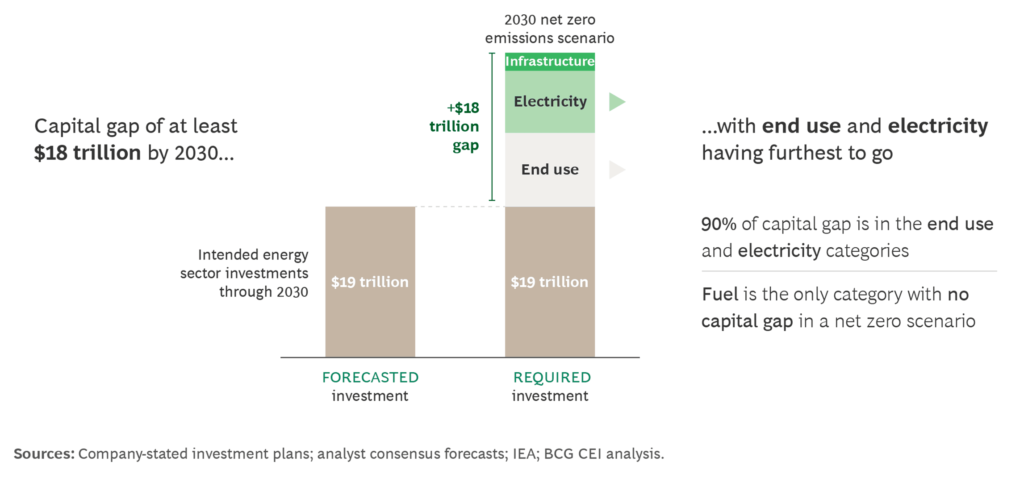

The $18 Trillion Net-Zero Capital Gap

The colossal capital demands of the energy transition underscore the necessity for both companies and policymakers to adopt robust and innovative approaches

In their recent analysis, the Boston Consulting Group’s Center for Energy Impact shed light on the global energy sector’s journey towards achieving net-zero emissions by 2030. The findings reveal a substantial challenge – a staggering $18 trillion capital gap exists between current commitments and the investments required to align with net-zero goals. This shortfall predominantly affects the electricity and end-use sectors, constituting 90% of the financial challenge.

Figure 1: The $18-trillion capital gap; Source: BCG Research

A path beset with challenges

The transition to cleaner energy is not without its hurdles. Over the past two years, higher inflation rates, supply chain disruptions, and escalating capital costs have emerged as significant barriers – impeding the progress of the energy transition and escalating overall costs. Investor behaviour has also evolved in response to heightened risks, favouring businesses that exhibit capital discipline and cost efficiency, even within the rapidly growing renewables sector.

The industry’s response has been proactive, marked by a flurry of transaction activities totalling over $320 billion in 2023. Oil and gas companies are leading the charge with strategic acquisitions, while utilities are strategically offloading assets to recalibrate and access capital. The evolving capital markets emphasise the importance of projects striking the right balance between risk and returns to secure funding. Regions where policy directives and market mechanisms align effectively stand to become prime recipients of future investments.

To meet the escalating capital demands, energy companies are urged to reassess portfolios, innovate in capital strategies, form new partnerships, optimise financial structures, and enhance cost and supply chain efficiencies. The BCG report underscores the pivotal role of these measures in amplifying investments, satisfying shareholders, and steering towards net-zero outcomes.

The 2030 challenge

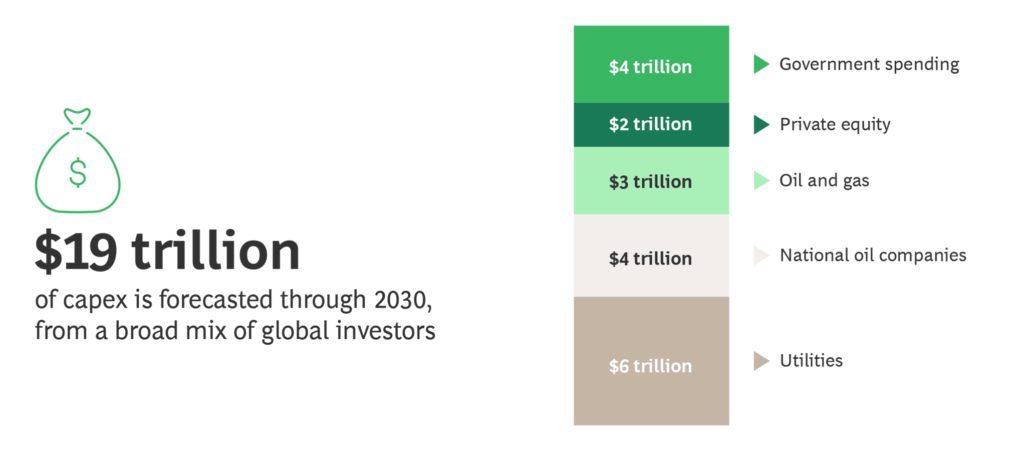

The study by BCG’s Center for Energy Impact, examining the investment plans of leading energy companies, governments, and private equity players, reveals two major trends. Firstly, a collective injection of an impressive $19 trillion into the energy transition is anticipated over the next seven years. This includes nearly $4 trillion in new government spending, propelled by legislative initiatives in the US and Europe. Companies are targeting a 15% increase in energy expenditures between 2023 and 2027, with a growing share dedicated to low-carbon investments.

2: Projected investment towards net-zero by 2030; Source: BCG Research

However, the aftermath of the Ukraine conflict looms large, impacting capital availability, particularly for European utilities – the linchpins of European decarbonisation efforts. Financial headwinds, coupled with higher inflation and capital costs, have dampened enthusiasm for new investments.

Recognising the pivotal role of policymakers, the report stresses the urgent need for global leaders to address existing challenges and facilitate a fair and efficient shift to low-carbon energy. The blueprint for the energy transition outlines six essential steps for public sector leaders to bridge the investment gap, encompassing modifications to electricity markets, faster project approvals, enlarged green investment subsidies, and revised liability guidelines.

The energy sector, with its intense capital demands, necessitates strategic imperatives for corporate action. Approximately one-third of the world’s yearly capital expenditure is dedicated to this sector, making it essential for organisations to amplify investments, satisfy shareholders, and navigate towards net-zero outcomes.

For an accelerated energy transition, every company in the sector should consider six mandatory actions: refining capital allocation processes, emphasising cost and capital efficiency, exploring strategic mergers and acquisitions, forging new partnerships, strengthening financial resilience, and rigorously evaluating supply chains for cost efficiency, carbon intensity, and resilience.

The colossal capital demands of the energy transition underscore the necessity for both companies and policymakers to adopt robust and innovative approaches. While the energy sector is making progress, consistent policy support and forward-thinking financial strategies are paramount to bridging existing gaps and ensuring an ordered, equitable, and sustainable shift to a greener future.