India Takes Huge Innovation Leap, But Only 0.4% Patents are ‘Working’

While India’s patent ecosystem has seen significant improvements, a critical question remains: Are these patents truly impactful, or are many of them merely symbolic filings?

Over the last few years, India has shown a remarkable rise through the global Innovation Index league table. It currently holds the 39th position – quite a leap forward from its 81st ranking in 2015. The numbers tell a compelling story. Patent filings in India surged by 63.5% over the past five years, reaching a record 82,811 applications in 2022-23, according to the latest Indian Patent Annual Report.

Sabyasachi Powers Design Thinking with 900 Filings

A rather fascinating data from the report reveals that Sabyasachi Calcutta LLP is the leading Indian applicant in design registrations. In 2022-23, the entity filed over 900 design applications, securing the top position among Indian applicants for design registrations.Sabyasachi Calcutta LLP shows a remarkable trend of domestic applicants having outpaced foreign ones for the second consecutive year, marking a significant milestone. Over 52% of patent applications now originate from Indian entities, a sharp contrast to the foreign-dominated landscape of just a decade ago.

Kolkata Generates ~97% of Patent Office Revenues

The other, perhaps even more incredible, data from the same report shows the revenue of the Kolkata office of the Indian Patent Organisation in 2022-23 clocked a whopping INR 8.23 crores through fees collected for design applications and proceedings under the Designs Act. The Delhi office came a distant second with INR 17.65 lakhs, Mumbai with just INR 6.8 lakhs, and Chennai making up the tail with INR 4.36 lakhs.

Nevertheless, this is where we need to take a pause and look under the hood to examine the data in detail, and as they say: the devil lies in the detail. Despite all the headline-making statistics, India’s research and development (R&D) sector faces significant challenges, primarily characterised by its low expenditure on R&D, which is less than 1% of its GDP. This figure is notably lower than the global average, despite India being the fifth largest economy in the world.

India Lags in R&D Spend

India’s investment in R&D has more than doubled in the last decade, yet its expenditure remains between 0.6% to 0.7% of GDP. This figure is significantly lower than that of other countries, such as China (2.4%), the USA (3.5%), and Israel (5.4%), as reported to the Rajya Sabha.

A major portion of R&D funding in India is sourced from the public sector, with the private sector contributing only 36% to the gross expenditure on R&D (GERD). The Indian Institute of Technologies (IITs) collectively filed 803 patents, which positions them prominently among Indian entities. This reliance on public funding contrasts sharply with trends observed in global R&D leaders such as the United States, Germany, and South Korea. Factors such as regulatory ambiguity and a weak patent system discourage corporate investment in R&D, further exacerbating the funding issue.

India’s progress, while commendable, pales in comparison to the strides made by global leaders. The United States, for instance, granted over 320,000 patents in 2022, nearly 10 times India’s 34,134 grants. Its robust ecosystem for patent commercialisation, backed by technology transfer offices and public-private R&D partnerships, ensures that most innovations see the light of day.

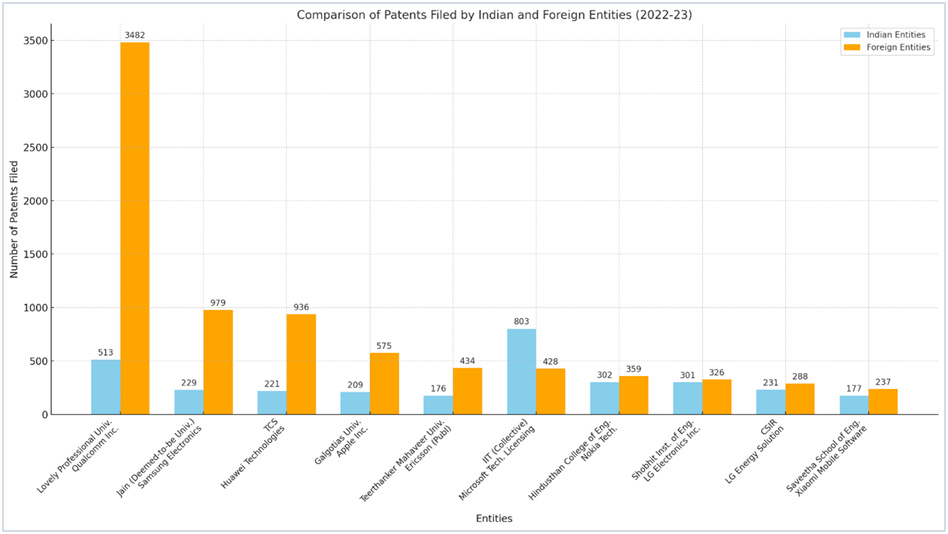

China’s story is equally instructive. Driven by government incentives and strategic focus on emerging sectors like AI and green technologies, China filed over 1.4 million patents in 2022 – the highest in the world. Even Qualcomm, an American giant, filed more patents in India (3,482) than the top Indian applicant, underscoring the global tech industry’s dominance in the Indian market.

Global MNCs Dominate India’s Patent League Table

Qualcomm leadership in India’s patent filing league table underscores another eye-popping aspect of the innovation story. Global MNCs are leading in patent filings from India. Qualcomm is followed by Samsung with 979 filings, Chinese telecom giant Huawei Technologies, which has recently launched an automobile, comes next with next with 936, while Apple ranks fourth with 575, and Swedish telecom giantEricsson comes fifth with 434 filings.

Contrast this with the Indian companies which have filed patents, and the picture becomes quite alarming. Lovely Professional University leads the Indian team with 523 applications, Jain (deemed to be university) comes next with 229 filings, and the largest of Indian IT service companies employing over 600,000 professionals has filed 221 applications – making it rank fourth in the list. Galgotias University comes fifth with 209 applications.

Only ~0.4% of Patents are ‘Working’

The narrative takes an even more dismal turn when we analyse the data on the number of patents that are actually active and being monetised.In 2022-23, only 560 patents were reported as “working” out of 137,333 patents in force, representing just ~0.4% of the total. Possible reasons for this low percentage include the prevalence of defensive patents filed to block competitors rather than for commercialisation, a lack of commercial viability for some inventions due to market conditions, and significant foreign ownership of patents that may not be utilised locally. Additionally, resource constraints for start-ups and small entities often hinder their ability to develop patented inventions, while awareness and compliance issues lead many patentees, particularly smaller firms and individuals, to neglect the requirement to report working patents accurately.

Are India’s Patents Falling Short of Real-World Impact?

The low number of working patents has significant implications. Firstly, missed economic potential arises as underutilised patents fail to contribute to industrial growth, employment, or technology diffusion. Additionally, there are legal risks, as patents not worked in India for over three years can be challenged for compulsory licensing under Section 84 of the Patents Act. Furthermore, the issue of underreporting complicates the situation, as the true number of working patents could be higher but remains obscured by inadequate compliance with reporting requirements.

While India’s patent ecosystem has seen significant improvements, a critical question remains: Are these patents truly impactful, or are many of them merely symbolic filings? A substantial number of patents remain inactive or fail to be commercialised, leading to questions about their contribution to India’s innovation economy.

The Indian government has implemented various tax incentives to promote R&D, notably the ‘patent box’ regime, which offers a reduced tax rate of 10% on income derived from patents developed and registered in India, aiming to encourage indigenous innovation and the commercialisation of intellectual property.

While the increase in patent filings indicates a positive trend in innovation, concerns have been raised regarding the quality and commercial viability of these patents, as some companies may prioritise the quantity of patents to leverage R&D tax benefits, potentially leading to filings with limited market applicability.However, this perspective doesn’t fully capture the complexities of the innovation ecosystem.

Nevertheless, several factors suggest that many patents filed in India possess substantial business potential, including an increase in patent grants, with the number rising by 13.5% from 30,073 in 2021–22 to 34,134 in 2022–23, indicating that a significant proportion of applications meet the stringent criteria set by the patent office, and India’s rank as the fastest-growing major economy in patent filings underscores the global competitiveness of its innovations, with prolific patent filings in sectors such as pharmaceuticals, information technology, and engineering, known for their focus on commercially viable innovations.

Frugal Innovation – ISRO Shows the Way

India’s strength in the global innovation race, is its ability to produce high-impact outcome with meagre resources. The finest example of this frugal innovation is the Indian Space Research Organisation, that captured the imagination of the world with its ultra-cost Mars Mission: Mangalyaan. ISRO continues to rewrite the rules of the global space race. Its latest feat – launching the European Space Agency’s Proba-3 mission to study the Sun’s inner corona – underscores how the country’s low-cost, high-impact model is reshaping the global space economy.

ISRO’s cost-effective approach is rooted in frugal innovation: resource optimisation, homegrown technologies, and streamlined operations. Missions that cost hundreds of millions elsewhere are accomplished at a fraction of the price, earning India a reputation for affordability without compromise.

This strategy has turned ISRO into a magnet for international clients, positioning India as a go-to destination for reliable, budget-friendly launches. With the global space economy booming, India’s own sector is projected to reach $13 billion by 2025, fuelled by a vibrant ecosystem of startups and increased private-sector participation. In a world where space exploration often comes with astronomical price tags, India is proving that you don’t need to break the bank to reach the stars. India’s corporate sector does not need to look far for its innovation inspiration.As the saying goes: when resources are limited, imagination is unlimited!

Acknowledgement:https://ipindia.gov.in/annual-reports-ipo.htm